Attention Youth Program Members*:

We have some exciting news!

Starting January 2026, we are updating our Youth Account program to be more simplified and accessible for our members. There is no action required by you, but we want to keep you informed about your account and any changes.

To simplify our Minor Accounts, we have decided to move all our 014 (minor) accounts to 000 (regular savings). We previously had a different suffix to differentiate minors from adults, which is no longer necessary with system upgrades.

We are making sure this will be seamless for you, by updating any ACH deposits or withdrawals, AFT’s, ATM cards, Payroll Distributions, and anything else that might affect you.

In addition, we are now opening our Minor accounts and Teen checking accounts to those 13 years old and older! That means, you will be able to withdrawal from your savings account and a Teen checking with a debit card (with approval from a joint owner 18 years or older on the account). To be eligible for this new arrangement, a new membership application must be signed by you and all joint owners on the account. We also will need a copy of your current year Student ID, State ID, or Passport for identification purposes.

*Ages 17 years old and younger.

New Youth Program

Let MFCU help you start your savings journey!

Introducing our new youth program theme, “Jump into Savings.” This program is available to all of our members ages 17 years old and younger. Click here to learn about:

- Money and Financial Literacy

- Resources Information about our Youth Accounts

- Credit Union Events

- Activity Sheets

- Contests

- And more!

Financial Literacy and Education

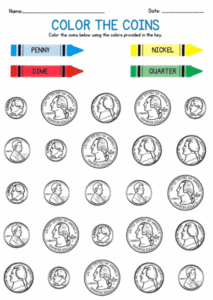

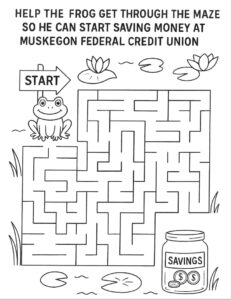

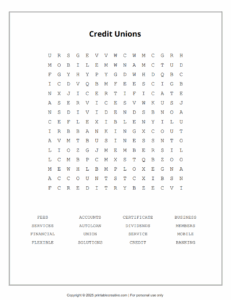

Activity Sheets

Start your learning journey with a fun Activity Sheet!

Resources

Learn more about Credit Unions, accounts, and how to manage money with interactive games, webinars, videos by visiting

Credit Union Events

Stay tuned for the announcement of Credit Union Events

- Scholarship Raffle Entry

- Youth Week

Contests

New contests will be announced April 2026!